ESG Report Pricing

Cost of ESG reporting in 2024

From this article you’ll learn how to prepare for the upcoming wave of procedures and paperworks regarding ESG as well as estimated costs associated - based on various examples, including our experience.

Article is written on behalf of the Quality ESG - ESG.ngo initiative, under the umbrella of the Central European Chamber of Commerce - cecc.ngo

QESG (esg.ngo) aims at easing and automating ESG reporting through collaborating with experts in their respective fields, covering the entirety of Environmental, Social and Governance data points.

ESG report - what we'll learn today?

We divided our article into three parts, with the first one revolving about general matters and what we all need to know. Then we dive into the realm of nuances and preparations. At the end we'll discover the implications and significance of ESG in business relations and operations.

Basics:

- deadlines for ESG report and who needs to do file the report

- how it looks like and what ESRS really stands for

Preparations and Consequences (of neglecting):

- what are the implications of neglecting or ignoring the process,

- how to start my journey and best practices,

- what is Double Materiality,

What are the true costs:

- finally, how much it should cost and how much it really costs,

- what are the hidden costs of compliance,

- how QESG can help you with compliance with little effort on your side,

If you are ready for the journey, it's good to know when we departure.

When to file an ESG report?

- Hans, what if this regulation fails?

- We’ll release “Correcting form 392B/7”

And what is ESG after all?

If you are not familiar with ESG - Environmental, Social and Governance sustainability reporting, orbiting around non-financial metrics. Until now it was a trend among companies dealing with the largest financial institutions such as BlackRock.

Risk Assessment

ESG are the factors to measure sustainability of the company looking at an organisation both - in a traditional way (outside in) to assess potential risks for a business but also expecting managers to consider how organisation impacts environment, communities, supply chain and regulators (inside out).Its a much more comprehensive approach but in the eyes of top decision makers (aka institutional banking system) it's becoming a vital part of risk assessment.

From 2024 it’s part of EU regulations (in a form of ESRS directive), creating roadblocks for those who won't comply.

Deadlines and obligations within the EU?

Following article explores obligations for companies within the EU area, based on the ESRS directive. Although not in all European countries relevant regulations have been put in place - as of April of 2024 - we all have clear guidelines and respective acts that need to be followed therefore we can safely proceed with consulting and guiding clients.

In the European Union, companies who meet a certain criteria (see image below) are obligated to file a report for 2024 before 30th June 2025. Although you might think you have time, reporting itself might not be as easy as you might think.

Who needs to report for 2024?

Large companies with over 500 employees.

It applies to me, what now?

If it applies to your case, you might have some preparations made already.

All the ISO certifications and others are a great ease as they prepare you for such tasks and you have many records already in place. However, if you still want to know more about possible solutions to save time while transitioning smoothly this article will help you to explore options.

I’m not reporting ESG this year

If you think you are beyond the scope of regulators this time, you might be surprised to hear from your clients or supply chain when they ask you for ESG related matters, especially those connected to carbon footprint and inclusivity standards of your company.

Keep in mind that criteria for 2025 and 2026 will be less tight, creating a situation where most companies operating on a minimum level of revenue or headcount will be obligated to file a report while remaining part still be expected to meet many criterias required by their business clients.

ESG report - What does it look like?

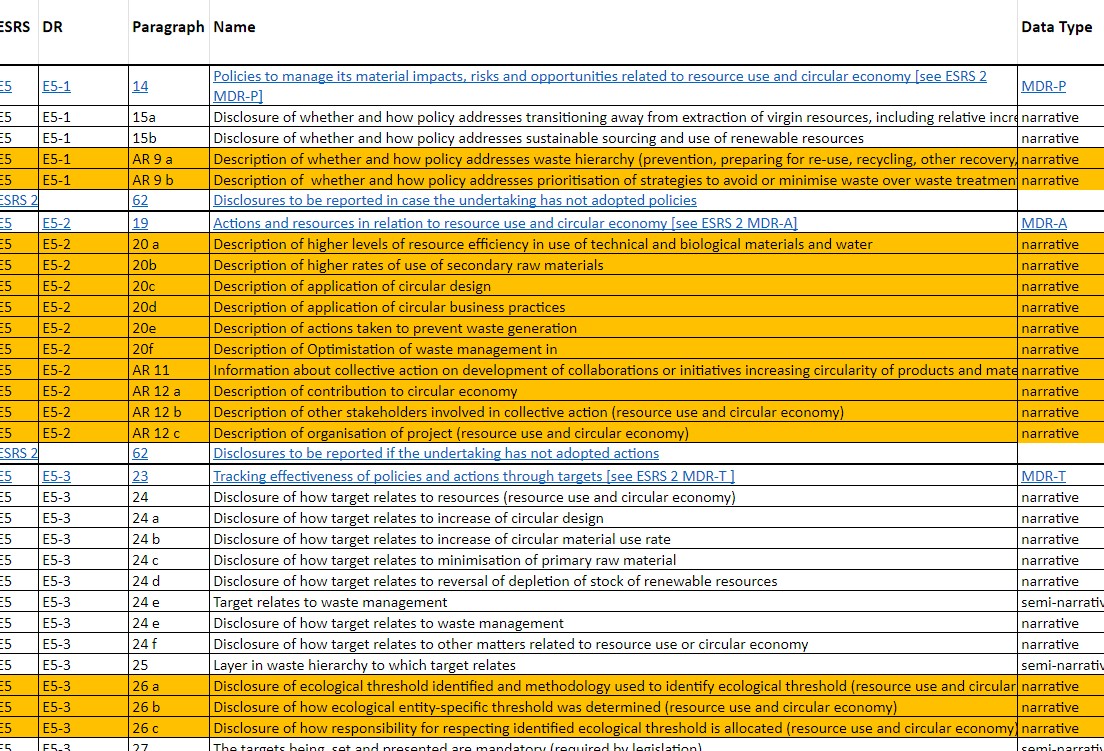

With over 1200 data points to potentially include, this illustrations'

the only purpose is not to scare you off with a thick sheet of paper.

The structure of the report is based on ESRS guidelines and data points described very precisely. Final report needs to include all required fields (unless proven non-material). As for the visual and narrative form it's up to each company and consultants to shape it.

Quite often what's highlighted in the report takes into account public relations (PR) therefore some companies take best examples from foreign markets to look upon.

Examples from United States

A: Chevron (oil company) sustainability report 2022.

What’s interesting there is that not always you have to be overly ambitious about your scores as long as you are transparent - look at page 58.

https://www.chevron.com/-/media/shared-media/documents/chevron-sustainability-report-2022.pdf

B: UnitedHealth (medical care behemoth) sustainability report 2022.

What’s interesting in their energy and GHG (GreenHouse Gases) scores changes drastically, showing their transition to in-house processes. You can look closer at their performance chapter, starting with page 79.

https://www.unitedhealthgroup.com/sustainability/reporting-and-data.html

What we - ESG consultants - have learned?

Most valuable lesson from US companies' ESG reports is how they categorise and deal with stakeholders. It’s something that helped us in QESG to shape our signature Six-Six-Sixty programme guiding clients through ESG reporting in the European Union.

The importance of ESG reporting

- Looks like we filled form 256x/B instead of 256X/b

- If we file 504x7/x9 we’ll gain an extra 2 weeks to rectify.

Is it really that important? Well yes, and no. You might of course decide that you don’t really care about things like that and want to stay away as long as possible. How could it hit you? And when?

What if we decide to ignore ESG reporting?

There are some roadblocks awaiting an organisation that does not comply with how business should be carried on - globally - from this year.

ESG creates an obstacle to participate in commercial activities on many platforms. Whether you are an IKEA contractor, want to sell your products on Amazon or be a part of consortiums or larger ventures, sustainability reporting is not a thing you’d like to ignore and it might pause your daily operations at some point or delay new projects.

Delaying ESG reports might put you on a side track

of commercial activities.

(Re) Financing your future

Our partners (speaking on behalf of CECC Chamber of Commerce) are already facing multiple questions related to ESG regulations and compliance when engaging with financial institutions and their clients.

Imagine speaking with a bank representative about refinancing your loans or extra credit line. The amount available as well as terms - mainly percentage rates - are from now connected to how your ESG public profile looks like. And this is determined by your latest ESG report or benchmark numbers for CO2 emissions (and equivalents).

Looking into the future, expect difficulties in negotiations with financial institutions and many questions regarding your ESG stand. Those who harness the opportunity might jump ahead of you in a queue for your clients’ budget and contract, based on the fact they contribute more to your - former - client’s ESG profile and Carbon footprint scoring.

The scoring system not only provides your stand among environmental savy entities but also speaks volumes about your risk management.

A narrow point of view - risk assessment

Another roadblock is related to how a company conducts a risk assessment analysis. For ESG (and ESRS) it takes the form of Double Materiality where you examine each aspect from the mentioned outside-in and inside-out perspective.

Performing Double Materiality Assessment requires interdisciplinary studies influenced by stakeholders' stand about the company's impact. The idea is to look at the company not only from outside-in, analysing external factors for future strategies but also inside-out, looking at the influence your business conduct might have on surrounding ecosystems, communities and regulators.

"The sheer breadth of ESG means there is a wide variety of data needed from multiple sources, and this comes in many different formats, structured and unstructured, across many domains including climate/carbon, customer, employee risk and more(...)"

KPMG, “ESG in Insurance” report

Examples of data you collect to prepare your ESG report as well as overall strategy that might help you look at your business from various perspectives:

- internal data (BI and analytics),

- third party data (reports, benchmarks, industry statistics etc.),

- suppliers surveys and interviews,

- market research and end-user surveys,

- financial authorities stand,

- government strategies for the sector and local communities,

The most important part of collaborating with stakeholders is to help your organisation gain outside-in perspective. Don't be mistaken, the same approach will apply when your company is examined by insurance companies.

Insurance and Sustainability:

How ESG Factors Impact Business Operations

CEO of BlackRock was one of the first vocal proponent of ESG reporting

and outside-in perspective when dealing with credit line.

"80% of global investors say how a company manages ESG risks is an important factor in investment decision-making."

Deloitte, “UK, CSRD benchmark” report

It's enlightening to realise how many elements of your operations are backed up by insurance policies. This aspect might also change significantly based on your profile in social responsibility as well as carbon footprint and GHG emissions.

In extreme cases you might be banned from some types of operations as insurance companies might not support your type of operations.

As you know, the true cost is not a cost of consulting as it might be similar or equal to a regular compliance and certification costs* but rather the cost of lost opportunities and financial uncertainty.

*according to EU officials

Most noticeable burden might be that your clients feel a true pressure to report as good benchmarks as possible, as they usually also have clients - such as corporations - or they are responsible for PR campaigns, targeted to the retail market. And as you'll see, customers are ruthless.

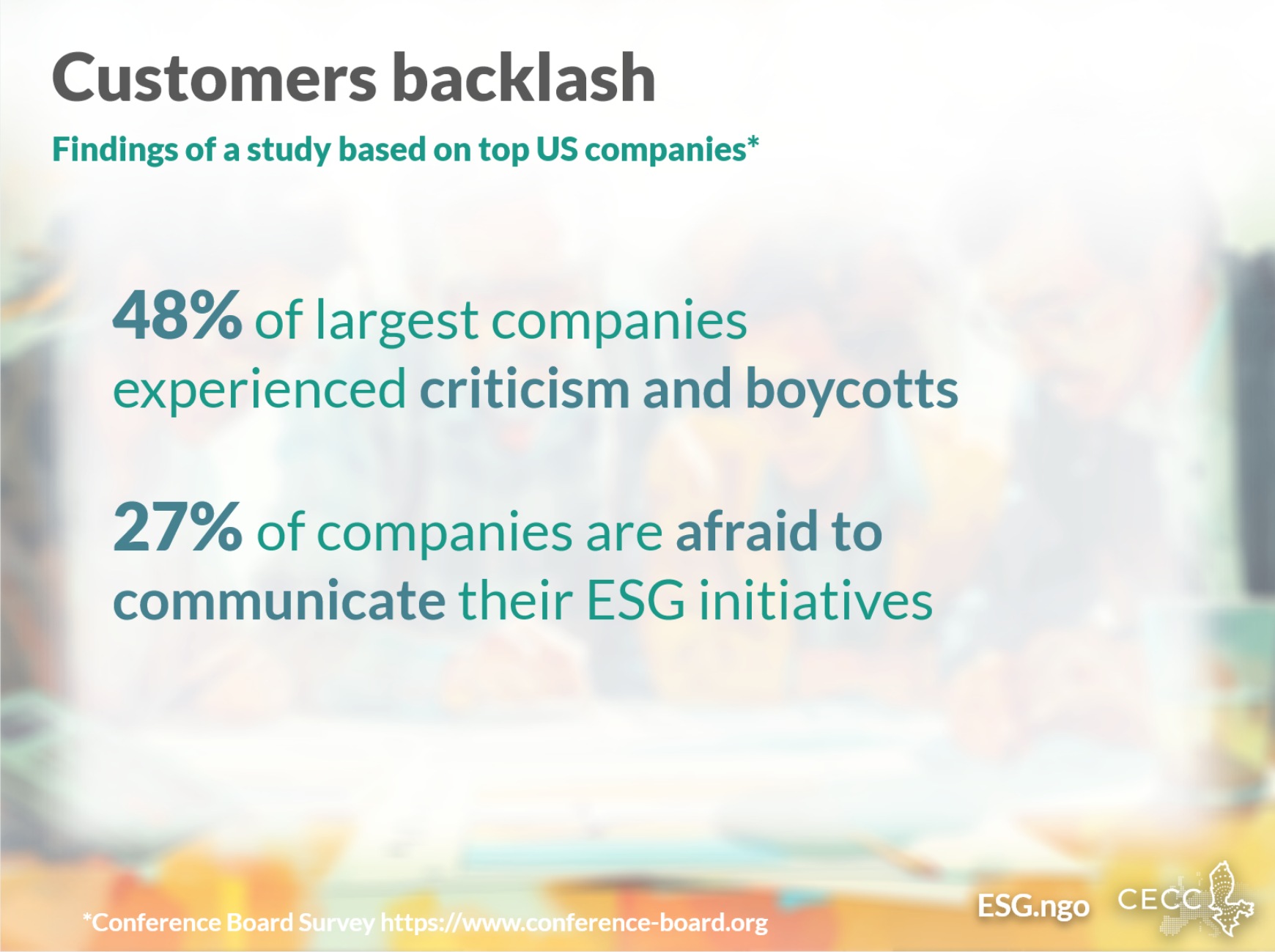

Impact of ESG on Market Presence - A (surprising) risk of overdoing

According to studies based on top US companies, last year alone almost half

of the companies faced criticism over their ESG strategies and decisions.

With the broad studies necessary for Double Materiality assessment, a company's marketing department also gains valuable insights into their customers and communities that might affect their perception of a product or a brand.

Quite often retail space (business-to-consumer or B2C segment) feels extra heat from difficult to satisfy consumers, in extreme cases facing boycotts and PR crises. For them not only CO2 emissions come into play as social responsibility becomes a vital part of daily business activities.

Neglecting sustainability studies might withdraw your organisation from the market reality, leading to losing a leading position and favourable brand image as well as dwarfed relevance in consumers' eyes.

ESG Reports - How to start?

- I have a call with a client tomorrow.

I need you to join, so we can quadruple the hourly rate.

Best practices for ESG reporting - How to start?

While working with clients and engaging with fellow consultants across the full ESG spectrum, we recognize the challenge that the first ESG report due in June 2025 presents an uncharted territory for many.

Understanding ESG reporting standards is crucial as companies prepare to navigate through the new requirement.

Learning how to do ESG reporting effectively, involves familiarising yourself with the data collection and analysis processes dictated by these standards, which aim to enhance transparency and stakeholder trust.

Preparing an ESG report requires a structured approach - from data gathering on environmental, social, and governance aspects to integrating these insights into business strategies.

As the 2025 deadline approaches, companies must ensure they are equipped with the right tools and knowledge to meet these reporting obligations and support their long-term sustainability goals.

[CTA]

Follow ESRS guidelines (only for the brave)

There are over 1200 data points to consider in your double materiality assessment which you have to discuss with your consultants, stakeholders and management, making final decisions regarding the narrative as well as the weight of each one in regard to your operational and external impact.

Generally, all consultants start with what the EU proposed in ESRS directive further divided into 1200 data points, packed in a scary and a vast spreadsheet document.

As overwhelming as it might seem, this is a good start to begin your preparations. Of course going through all the data points with your team might not be possible and - in many cases - not necessary. While working with consultants like QESG you’ll soon discover we have a curated list of aspects we really need you to focus on with a lean version of questions that might help you to collect the necessary information.

Essential task - define ESG Materiality

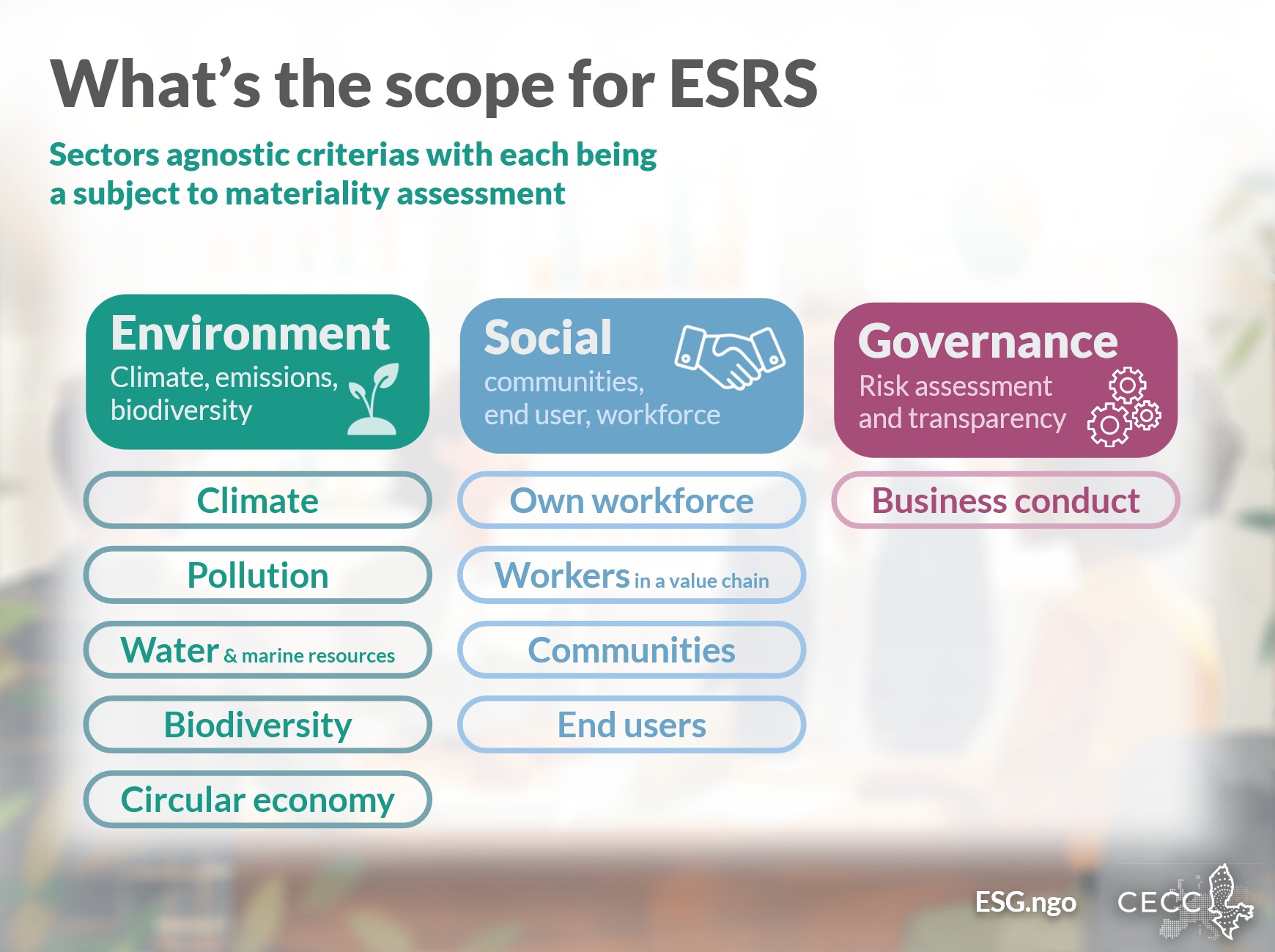

Three main sector agnostic pillars of ESG have been broken down into divisions each company has to qualify as material or not.

In most cases consultants will work with you closely to help you to decide which specific metrics are material in your case.

For example, if your real estate footprint is not significant (for example you only employ working from home teams, having a modest amount of floors of commercial real estate rented for administrative roles) and you don’t deal with marine resources in your supply chain, aspects such as marine biodiversity might not be relevant in your case.

Make sure however to work with professional consultants on those matters as each aspect needs to have valid arguments for exclusion. Our team at ESG.ngo prefers to work with clients based on questionnaires while sourcing essential data before exhausting your employees with the large amount of paperwork they need to perform.

Why should you trust ESG.ngo?

We developed and constantly are perfecting our framework of a 6 months process, made of 6 steps and designed to only consume 60 manhours on the client's side.*

Our signature six, six, sixty programm.

If you need professional help to transform your business conduct to be compliant with ESRS guidelines look no further.

QESG consultants navigate clients through the process smoothly and with minimal impact on your operations, feel free to contact me or fill out our on-line questionnaire.

*Small caveat - 60 working hours on client’s side excluding complex cases of GHG and waste management.

What are the costs?

- EU bureaucrats estimate a cost of €40.000.

After a thorough research we've found... a missing zero.

Price Tag of ESG report for 2024 - how much does it really cost?

Regulators, mainly EU bodies, have prepared an extensive process to estimate potential costs and benefits of such broad standardisation overhaul. It's up to us to interpret the numbers but according to the survey - conducted among companies obliged to report for 2024 - regulators have understood that the average cost of compliance might reach up to 40.000 EUR annually, per company.

Some of them - according to the surveyors results' interpretation - have reported no significant changes in charges made by auditors and consulting companies.

It might not be relevant for the Polish market as well as for the entities obliged to report in following years (as the directive targets smaller companies in consecutive years).

ESG report - how to bring costs down?

As it might widely contradict the common sense, here is what it might mean:

- if you have all the certifications, such as ISO and proper governance policies, you might not see much uptake in your expected expenditures,

- having a compliance officers on board before ESG came into play is also a significant factor of costs stagnates as it was already covered by initial expenses made earlier,

- in developed countries, among highly regulated branches of the industry, standardisation might be offset by previous efforts and expenses, contributing to overall net zero or insignificant increases in prices.

Clearly, in many cases the cost of ESG reports has been embedded into an organisation on a compliance and certification level. It might be probable, your organisation is well prepared and actual costs might not be as burdensome as some companies claim.

However it's not what the market indicates.

What market has to say (a survey)?

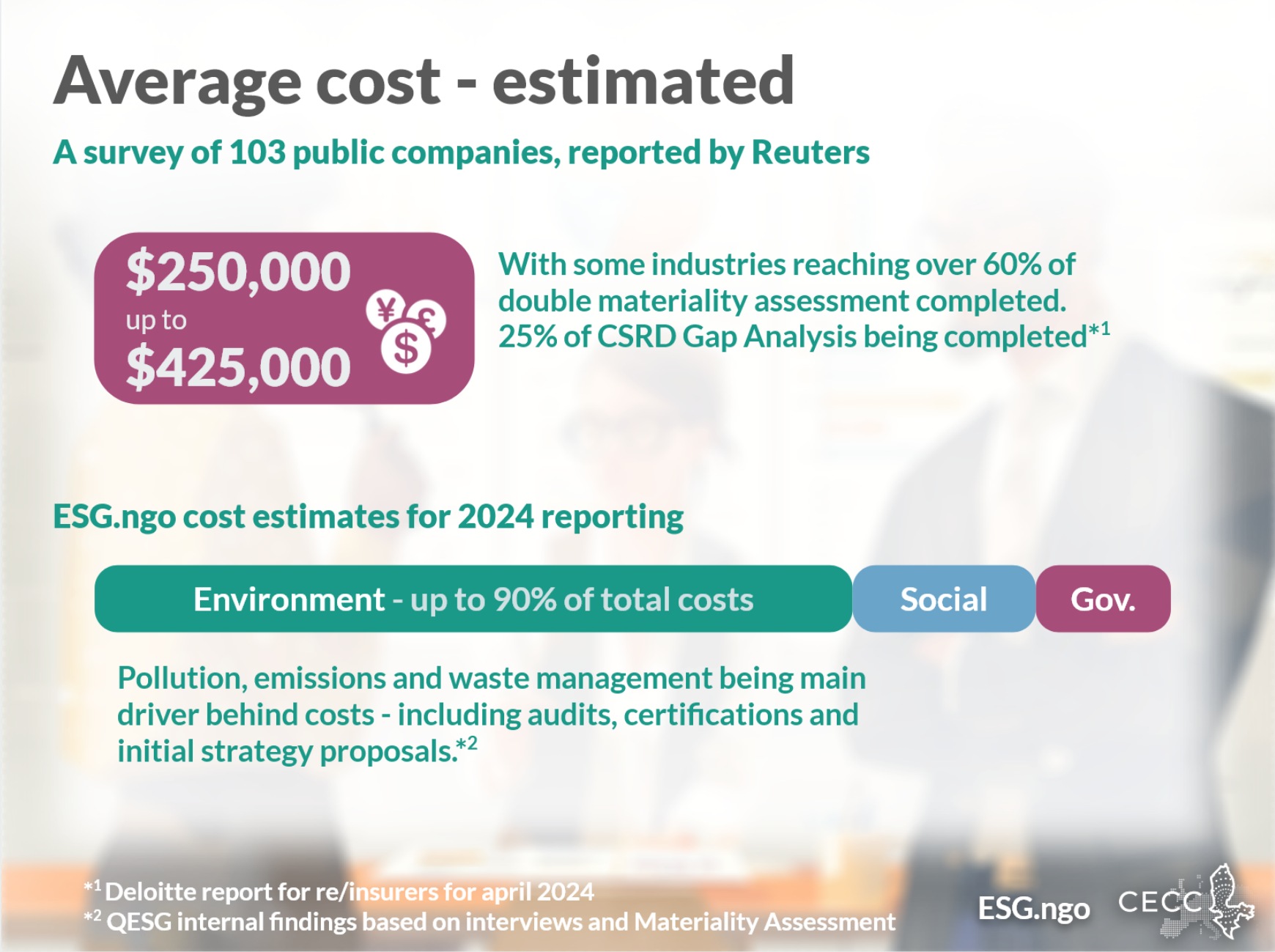

Let's hear the voice of people who had an opportunity to face the challenge of making an ESG report a reality. Interesting case emerges from the survey of 103 companies, reported by Reuters.

Total costs exceeding $400k were not uncommon

among surveyed companies.

According to the article, public companies are spending on average between $250,000 and $425,000 for rating related ESG reports and activities.

Worth mentioning is that not the report itself drives the costs but rather a complication of compliance clashing with regulations' requirements regarding emissions, pollution and energy efficiency ratings.

Costly and ineffective?

The top bracket - for surveyed costs - reaches nearly half a million USD while confidence about reliability of the data and the reflection of the company's efforts remains very low.

30% of the companies described confidence in ESG ratings as either Low or Very Low. According to the survey 95% of the companies are complying with ESG mainly to satisfy investors' demand for ratings to benchmark a company before making any financial decision.

What it means:

- access to capital will remain the main driver behind compliance and costs,

- access to markets (maintaining a relevance in a supply chain) is still significant,

- confidence for scoring relevance is rather low making it just another bureaucratic sheet of paper for almost third of the companies,

- morale regarding ESG ratings and a general idea behind it scores very low, which coincides with the fact that half of the companies in the US faced criticism over their ESG efforts.

ESG reporting in Poland

What is the Polish market saying at the moment? Reactions are mixed:

- 40% of the companies struggle to find experts in the field (according to Polish ESG Society) - both external as well as internal - helping them go through the process,

- beside largest consulting companies and auditors not many organisations are prepared to guide clients through the entire process,

- costs are often a wild guess based on working hours of consultants and blurry understanding of the process,

- many polish companies haven't certified their processes before, having rather low experience with compliance.

Cost of an ESG expert in Poland

In Poland, costs of experts in the field range from between 500 and 4.000 PLN (100EUR to 1000 EUR) per hour, where governance and environment matters require most work to be done through bureaucratic procedures.

In some cases, companies never dealt with extensive processes of obtaining ratings (such as waste management and energy efficiency). In such examples, audits can take up to a year, costing 20.000-30.000 PLN per month (not including own workforce).

ESG reporting cases in a ballpark of 10.000 EUR per month for surveying and paperwork are very much a reality.

Beside financial commitments

Polish ESG Society brilliantly summarised noteworthy aspects of such transformation, focusing on non-quantifiable and non-financial aspects which they listed:

- engaging various managers of a company into multidisciplinary process,

- position of a controller and auditor of their own supply chain and contractors, creating a burden to multiple entities,

- extra workshops, seminars and trainings for own workforce,

- constant loop of education and compliance training within a company involving all departments.

Join us on our Webinar

If you are curious about our approach and how our experience might help you transition to ESG-enabled company as quickly as possible, you might consider participating in our workshop webinar where we:

- teach the most practical approaches and share our experience,

- demonstrate automated tools and how you could approach problems in your organisation,

- share access to our resources and expertise as well as tailor made manuals.

ESG can be your success story

-we have finally found a consulting company that charges less than €1k per minute!

QESG guides you through uncertainties

QESG (esg.ngo) aims to guide clients through all the steps with our signature six-step-process. We have combined our network of experts from the Central European Chamber of Commerce with skills in Machine Learning and analytics to craft a unique and scalable process that minimises the burden on the client's side.

Our six-steps-process allows most companies to have a report, ratings and strategy in place within 6 months. From our experience a streamlined process backed by advanced AI can save hundreds of hours on client side, other consulting companies still rely heavily on manpower.

Total costs exceeding $400k were not uncommon

among surveyed companies.

Meet our Six, Six, Sixty programm

6 steps

- AI audit and a questionnaire,

- Collecting data (internal and stakeholders),

- Hybrid assumption phase (humans and AI),

- Materiality assessment,

- Drafting a report & strategy,

- Benchmarking,

6 months

Executing 6 steps framework usually takes 6 months (not including complex cases of energy and pollution assessment/audits and benchmarking).

60 hours

Process is highly optimised and easy to follow, minimising the amount of working hours on the client's side.

Let’s shape the (sustainable) future together

Beside the insights you gained today, you can expand your knowledge and network of experts by participating in our webinar.

Why is it worth it?

- we teach practical approaches and share our experience with AI-driven tools,

- demonstrating our framework and discuss relevant topics,

- sharing access to resources and expertise as well as useful manuals.

If you might have any questions or concerns, please contact us at esg.ngo

Preparing your organisation to report as well as shaping the future of your business is not an easy task. We believe we can make it a rewarding journey with plentiful insights and ideas on how to make your social footprint more user-friendly fostering a bond between your customers and your brands.

About the author

Marcin Rybicki

AI architect, specialising in project management and automation. Over two decades in developing Green Algorithms with the last seven years focusing on power efficient Machine Learning.

Developing and advocating for Explainable AI architecture MarieAI (marieai.com). My experience and passion for optimisation and responsible efficiency as well as years spent in law school has enabled me to lead projects that prioritise environmental, social, and governance aspects.

Sources

1. https://www.erm.com/news/survey-reveals-costs-and-benefits-of-climate-related-disclosure-for-companies-and-investors/

2. https://www.reuters.com/business/sustainable-business/companies-pay-up-500000-sustainability-ratings-report-2023-03-27/

3. https://marketbusinessnews.com/sustainability-reporting-what-is-the-cost/266920/

4. https://www.pwc.co.uk/issues/esg/sustainability-reporting.html

5. https://kpmg.com/uk/en/blogs/home/posts/2022/05/mandatory-esg-reporting.html

6. https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-insurance-csrd-benchmark-april.pdf

7. https://kpmg.com/uk/en/home/insights/2024/03/esg-in-insurance-a-practical-guide-to-sustainability-reporting.html